23+ tax deduction mortgage

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

No More Mortgage Deduction

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

. Single or married filing separately 12550. Web In order to itemize your return you would need to have itemized deductions greater than your standard deduction which is 25900 for a couple filing a joint return. Get Instantly Matched With Your Ideal Mortgage Lender.

Taxes Can Be Complex. Web Homeowner Deductions. Were working to resolve this issue.

Web Standard deduction rates are as follows. If youd like to receive progress updates sign up below. By not paying off your mortgage you can save funds into 401 ks 403 bs.

Taxes Can Be Complex. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web Mortgage interest.

You can deduct mortgage. Limiting the home mortgage interest. You can file for an extension by April 18 2023.

12950 for 2022 13850 for 2023. Web Basic income information including amounts of your income. Medical and dental expenses qualify for a tax deduction.

Say you have a 200k mortgage Jan-June 2022 then you sell that house buy a new one and have an 800k mortgage from July 1-present. Web Here are the standard deductions for the 2022 and 2023 tax years. Apply Get Pre-Approved Today.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Mortgage interest deductions are considered itemized. For taxpayers who use.

There is also a known issue some users are experiencing with the Mortgage Interest. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Offer is valid for a limited time on federal tax returns e-filed by 41823 at 11.

6 Often Overlooked Tax Breaks You Dont Want to Miss. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Homeowners who are married but filing.

Web For 2021 tax returns the government has raised the standard deduction to. Single taxpayers and married taxpayers who file separate returns. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home. But for loans taken out from. Married filing jointly or qualifying widow er.

Web The IRS places several limits on the amount of interest that you can deduct each year. 25900 for 2022 27700 for 2023. The terms of the loan are the same as for other 20-year loans offered in your area.

Web Mortgage Interest Deduction Limit. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Learn More at AARP.

Web However putting money into retirement accounts will help most anyone qualify for tax deductions. You can file between January 23 and April 18 2023. Taxes with an extension must be completed no later than.

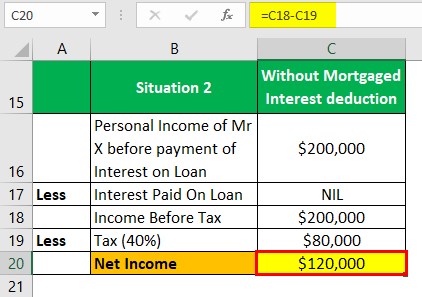

Web Here is an example of what will be the scenario to some people. Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Find Fresh Content Updated Daily For Mortgage tax deduction. 12950 for tax year 2022. Web Offer is valid for a limited time on federal tax returns e-filed by 41823 at 1159 pm.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web Some TurboTax customers may be experiencing an issue because TurboTax isnt allowing qualified customers to deduct the full amount of their home mortgage interest. Web IRS Publication 936.

You paid 4800 in. Ad Compare the Best Home Loans for February 2023. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

State Filing Fee. Lock Your Rate Today. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web Your mortgage interest will show on line 8b of your schedule A. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Housing In Ten Words The Baseline Scenario

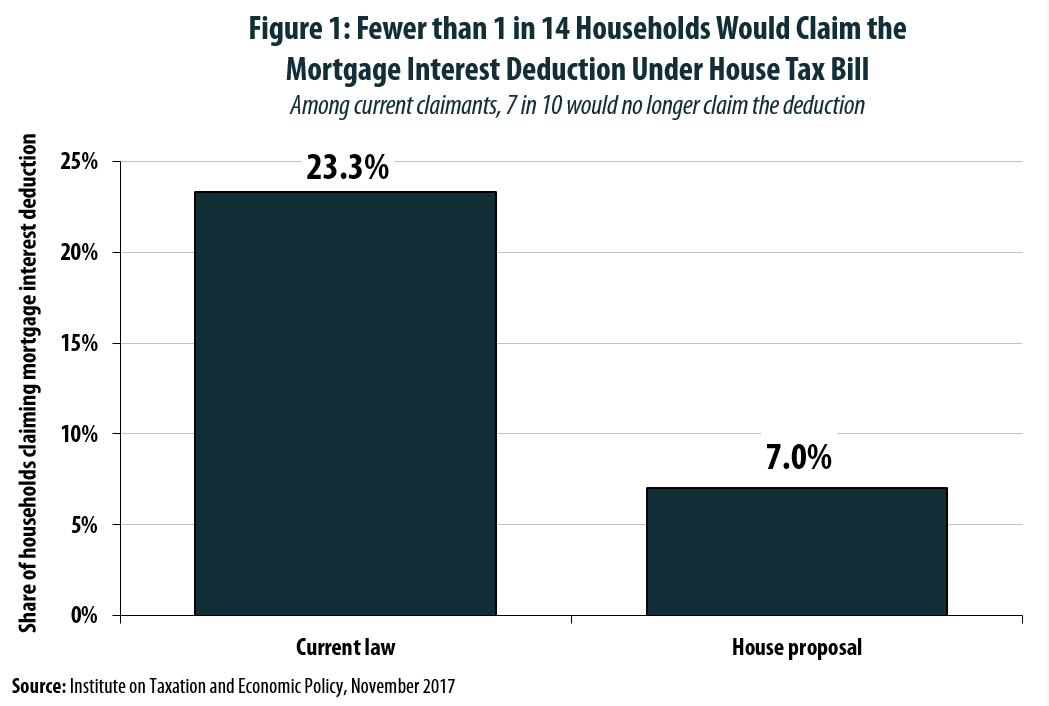

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

250 Best Of The Handy Tax Guy Ideas Money Tips Tax Tax Preparation

The History And Possible Future Of The Mortgage Interest Deduction

Additional Mortgage Tax Definition Propertyshark Com

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Is Mortgage Interest Tax Deductible In 2023 Orchard

How To Get The Top 3 Tax Deductions For 2023

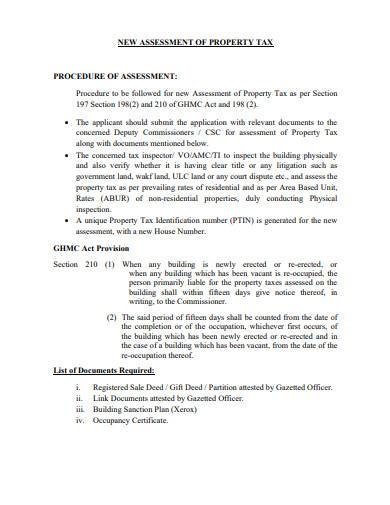

Free 10 Property Tax Samples In Pdf Ms Word

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Fairport Penfield Webster Edition Genesee Valley Penny Saver 8 23 2019 By Genesee Valley Publications Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Moneysprite London

Mortgage Interest Deduction How It Calculate Tax Savings

Key Dates For Your Finances 2022